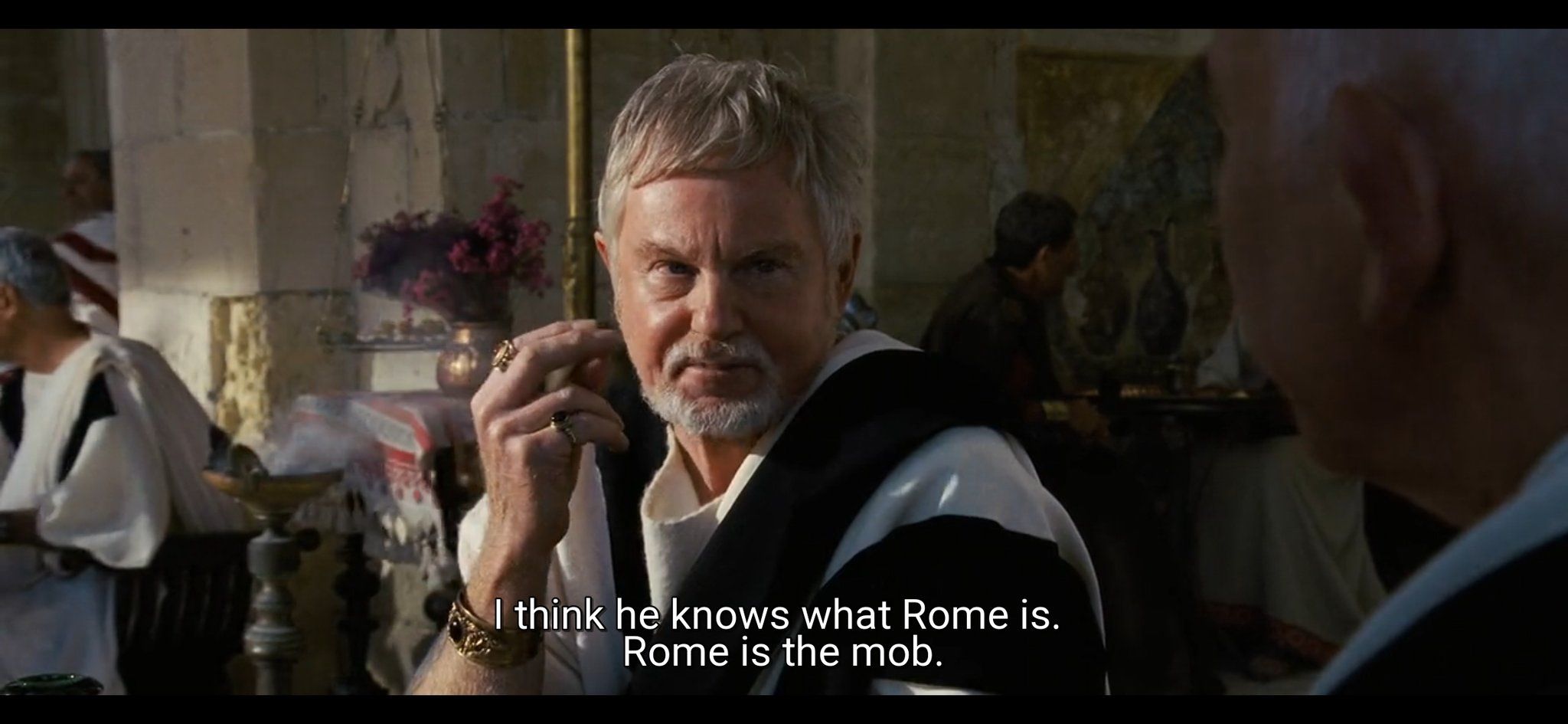

Rome is the Mob

Information Cascades

Let’s say we’re in normal times and you’re traveling in a remote country with no access to internet. You enter a wonderfully quaint town, famished after a long hot day. About mid-evening, you enter the town square and spot two restaurants. One is bustling with a line through the door, while the other has only a table or two occupied. Where do you go?

The uninformed visitor almost always goes to the busier of the two. They glean information from the demand dynamic without having to retrieve their Michelin guide or summon a Yelp review. This is perfectly sensible when dealing with a dearth of information: use supply/demand as a signal.

But what happens if everyone at the busy restaurant was also a tourist, and only went to the restaurant because they saw a preceding line of tourists also enter the restaurant? If we extend this, the supply/demand imbalance between the two restaurants could have been set off by a single party arbitrarily choosing one over the other. This is like a domino effect and is called an information cascade.

Narrative Cascades

Information cascades play a central role in financial markets and understanding them is an integral part of our investment process. They are important to markets because the instantaneous price signals offer stimulus to participants and reinforce biases towards our ultimate goal of underwriting a valuation. In English: price is not only a synthesis of information, it becomes information itself. The tail wags the dog.

Price vs value is not binary, but a gradient. There are periods where the dog is merely licking its tail versus running around feverishly in circles. It’s hard to untangle what is happening because so much of the short-term movement of security prices can be attributed to multiple expansion/contraction. As much as we try to make a science of it, it can be quite arbitrary. This is the voting machine / weighing machine dynamic of markets. What we do know is the arbitrary discounting of investments becomes hazy when the underlying dynamics of the business are uncertain.Some researchers have called these firms “boom firms”. Boom firms leave much to the imagination in terms of ascribing a value.

Returning to our example of the two restaurants, would an information cascade happen if all diners were locals who have frequented both restaurants numerous times? If the locals have developed informed, individual preferences about one versus the other, this would not constitute an information cascade. Our tourist should indeed follow that signal, because it is a synthesis of independent collective experiences. This is the wisdom of the crowds. On the other hand, if our participants were a procession of tourists following each other, we have an information cascade, leading to the mania of the mobs.

Cue the tiktok and r/wsb investing zeitgeist

The mania of the mobs is a recurring theme in markets and mutates every few years. These mutations are likely a function of changes in culture, technology, and popular sentiment. It is not solely a retail versus professional function; professionals succumb to manias (we are human as well). The degree of lunacy ultimately depends on the opportunity for price to untether from value. This tends to occur when narrative is a central function of that imbalance. Narrative is more explicitly informed by price signals than valuation. Price movements drive performance which create the behavioral drift impacting all market participants (what a poker player might call tilt).

The weapon du jour of this mob is the digital meme, and it is a particularly potent tool for shaping narrative. These memes more often than not mock the diligent and serious effort behind underwriting investments. This vernacular shapes narrative and empowers the mob because it is no longer playing a game where they feel disadvantaged. The parallels to populism are stark and sobering.

But the fixation on narrative is not solely the fiefdom of the mob. It extends to the corporates themselves. Savvy CEOs learned during this cycle the power of framing their narrative through powerful new mediums of content distribution. Many can exact more leverage on the performance of their stock through shaping narrative than through the release of their GAAP financials. This is the backdrop for fomenting information cascades.

If today’s market participants are cascading into things that have “grand vision”, then selling a grand vision unlocks a performant stock. A performant stock unlocks cheaper access to capital markets, provides an internal currency that can be used to lure and compensate talent, and pay packages that provide heads-I-win-tails-you-loose dynamics. It browbeats any teetotalers at the party.

Fever Breaks

Going back to our voting vs weighing machine analogy, narrative can only carry you so far. Ultimately the market will deliver a verdict on the intrinsic value of a company. But the path dependency of that can lead to ruin. As such, timing when a fever breaks is in our estimation a fool’s errand. It can last days, weeks, or months. It can occur for totally benign reasons or be catalyzed by something completely unexpected. A few things do tend to happen when cracks begin to emerge on a runaway narrative:

- Volatility increases quite quickly, as information cascades cause a jolt, which prompts revaluation of existing positioning

- Temporary dislocations become violent in seemingly unconnected ways

- Inevitably, levered players are taken to pasture

We are seeing some signs of this in the form of a mass deleveraging by the hedge fund and active long-only portion of the market. This is happening in part due to the cascade of losses arising from heavily shorted issuances. It has propagated throughout pockets of the market, as the price signal of selling causes otherwise rational actors to question the assumptions underlying seemingly normalized abnormalities. It will ultimately impact valuations.

This phenomena is particularly acute after a period of extended performance. The extent to which this ripple effect can carry forward is a function of how much leverage in the system needs to be flushed out, and how untethered from reality we have come. Like a storm feeding off a base of warm water, it will only exhaust itself when the ground-level conditions changes.

What to do

As it is our business to construct investment algorithms that seek to harness the wisdom of the crowds, we are on the lookout for the mania of the mob. We take a data driven approach to doing so, and our indicators are currently flashing yellow.

How one chooses to react to that information is not straightforward. We, for example, do not trade on what we think are technical dislocations. This has been a costly decision as of late. Looking back at the last few years, each technical dislocation has presented a buying opportunity as the temporary squall either proved to be transient, or the government intervened in ways to avoid a truly vicious cycle. But like the turkey who updates with a frequentist mentality, that type of blind reaction can be one’s undoing, and that is not a risk we are willing to take.

So ultimately, what one chooses to do depends on their risk appetite, and their confidence in underwriting the relative attractiveness presented with each unique circumstance. This is a healthy reaction to an unwind and is a wellspring for active participants to capture alpha.

We are always hopeful that bouts of volatility act to flush out poor actors from the system. This ensures that the structures remaining are those with solid foundations. Given what we see, it appears there’s a long way to go before the coast is clear.

---

The information contained in this article was obtained from various sources that Epsilon Asset Management, LLC (“Epsilon”) believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.